Managing income and expenses for rental properties can feel overwhelming. Accounting tasks often consume hours and lead to frustration when calculations don’t match or reports feel incomplete. Cloud-based property management tools streamline those tasks with intuitive tools and user‑friendly dashboards. It makes numbers easier to understand and reduces stress for anyone handling rentals. Navigating through reports becomes smoother, accuracy improves, and time opens up for strategic decisions rather than balancing spreadsheets. The smooth shift empowers landlords and property managers to focus on growth and better tenant care without losing time on mundane financial details. In this blog, we will discuss the role of accounting in property management software, highlights key financial features to look for, explains how financial reporting becomes more efficient with the right tools, and reveals why custom-built solutions are the smartest choice for landlords.

What is Accounting in Property Management Software?

Accounting within property management software refers to the structured process of tracking income and expenses associated with rental properties. Essential functions include recording rent payments, managing bills and invoices, processing vendor payments, and balancing ledgers. Accounting modules aim to ensure accuracy in financial records, provide audit trials, allow seamless bank reconciliation, and produce actionable insights. Designed to translate real-world financial transactions into digital entries, the software elevates bookkeeping from paperwork to real-time analysis. Focus on transparency, compliance, and operational continuity defines the professional standard for accounting features built for landlords and property managers.

Features to Look for in Property Management Software

Property management accounting requires more than basic bookkeeping; it demands precision, flexibility, and insights that support better decisions. Financial features within the property management accounting software must align with real-world landlord needs, reduce manual effort, and improve visibility across properties. The following are the most essential features to look for in property management software from a financial perspective:

Multi-Property Ledger Support

Separate ledgers for each property allow accurate tracking of income and expenses per unit. Consolidated reports offer a complete portfolio view when needed. The setup ensures financial clarity, reduces confusion, and improves reporting accuracy across multiple properties, helping landlords manage everything from single rentals to large real estate portfolios.

Automated Rent Tracking

Rent collection becomes effortless through automated tracking systems. The property management software monitors due dates, applies late fees, and sends alerts for overdue payments. Landlords save time and reduce payment delays with built-in notifications. Automation improves cash flow consistency and eliminates the need to manually follow up with tenants each month.

Bill and Expense Management

Vendors, maintenance, utilities, and all property-related expenses can be uploaded, categorized, and managed digitally. The property expense tracking software assign costs to the right property or account. Streamlined approval workflows reduce delays and errors. Landlords gain greater visibility into their spending habits, making it easier to control budgets and boost efficiency.

Bank Reconciliation Tools

Bank reconciliation features match bank transactions with internal records automatically. Transactions are identified using rule-based logic and patterns, speeding up the process. Early detection of mismatches prevents fraud and accounting errors. Such features reduce reconciliation time, improves accuracy, and offers landlords peace of mind during monthly or quarterly closings.

Budgeting and Forecasting

Built-in budgeting tools help landlords plan for operational costs and long-term investments. Forecasting modules analyze past trends to estimate future income and expenses. Property-specific budgeting enables smarter decisions around pricing, maintenance, and reserves. Clear financial projections support growth planning and help prevent overspending or unexpected shortfalls across the portfolio.

Compliance and Audit Trails

Complete audit trails capture every change made within the system, with timestamps and user tracking. Documents like invoices and contracts remain securely stored for reference. Read-only records preserve data integrity for inspections. Landlords maintain full regulatory compliance while gaining confidence in the accuracy and traceability of their financial data.

Custom Reporting Engine

Tailored reports offer deep insights into property performance, cash flow, profits, and expenses. Dynamic filters allow reports to focus on specific periods, units, or financial metrics. Data exports support easy sharing with stakeholders. Customization ensures that landlords receive only the insights they need, reducing noise and improving financial decisions.

How Financial Reporting and Accounting Becomes Easy With Property Management Software?

Accurate financial reporting and accounting become straightforward with the right property management software. Automation and real-time insights simplify complex processes, reducing errors and saving time. Here is how financial reporting and accounting becomes easy with property management software:

Streamlined Transaction Recording

Transactions such as rent payments and expense entries are recorded with minimal effort. Recurring entries auto-populate, while single transactions are quick to upload and categorize. Manual entry errors are significantly reduced. This streamlining allows landlords to focus on strategy instead of bookkeeping, while maintaining accurate and timely financial data.

Real-Time Financial Dashboards

Live dashboards display real-time insights into income, expenses, overdue payments, and overall financial health. Visual metrics make it easy to assess property performance at a glance. Proactive financial decisions become easier with access to current data, helping landlords respond quickly to changes and avoid costly oversights or missed opportunities.

Automated Report Generation

Financial reports can be generated automatically based on predefined schedules. Customizable templates align with internal or external reporting requirements. Reports are instantly available for teams, stakeholders, or tax filing. Manual formatting and repeated data compilation are eliminated, saving time while ensuring reports remain consistent, compliant, and ready for review.

Scheduled Reconciliations

Software schedules regular reconciliation sessions to match bank records with system entries. Any unmatched transactions are flagged for review. AI-assisted matching ensures speed and accuracy. Landlords gain confidence in their financial reports, minimize discrepancies, and spot potential issues early, without the manual effort usually required for bank reconciliations.

Alerting and Exception Handling

Custom alerts notify users about irregular activity such as missed payments, unexpected expenses, or unusual transaction volumes. Exceptions are highlighted for immediate review. Thresholds can be adjusted for flexibility. Financial risks are addressed early, giving landlords the advantage of reacting before small issues grow into serious problems.

Consolidated Portfolios Reporting

Reports across multiple properties can be unified into a single, high-level view. Drill-down options enable deeper analysis of individual units or categories. This consolidation supports investor presentations, budget reviews, and strategic planning. Landlords no longer need to compile figures manually across properties, saving time and improving decision-making accuracy.

Secure Document Storage

Receipts, lease agreements, invoices, and audit notes are stored directly with their associated transactions. Each file is securely archived and accessible on demand. Audit trails and financial reviews become smoother with everything in one place. Document loss, duplication, and filing confusion are prevented through centralized, structured, and organized storage.

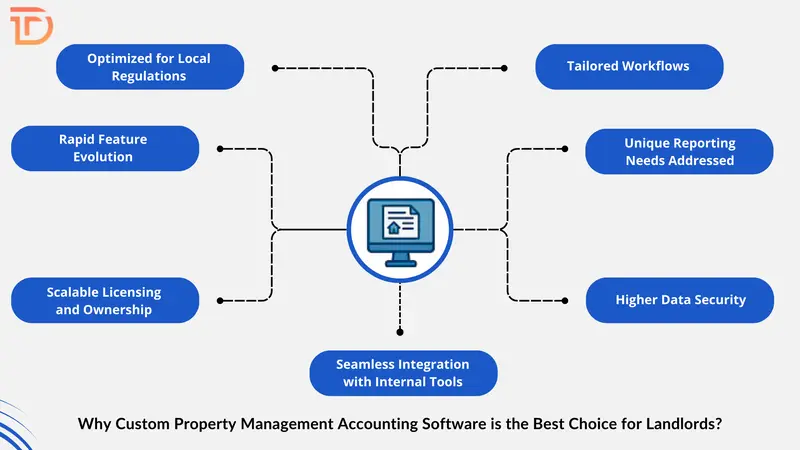

Why Custom Property Management Accounting Software is the Best Choice for Landlords?

Landlords face unique operational and financial challenges that pre built software often can’t address. Custom property management accounting solutions are purpose-built to align with specific needs, offering flexibility, precision, and long-term value. The following are the key reasons why custom software is the superior choice:

Tailored Workflows

Custom systems follow the landlord’s actual processes without forcing change. Approval chains, rules, and data flows mirror how the business already operates. Familiar workflows reduce training time and increase user adoption. This alignment leads to smoother transitions, fewer mistakes, and software that truly supports rather than disrupts operations.

Unique Reporting Needs Addressed

Every landlord has distinct financial metrics, KPIs, and portfolio goals. Custom software provides reports tailored to those exact needs. Dashboards display only relevant data, avoiding generic or bloated templates. We speed up decision-making and sharpen accuracy by building analytics around the landlord’s specific financial structure and focus.

Higher Data Security

Advanced security features protect sensitive financial and tenant information. Custom deployment options allow hosting on private servers or secure cloud environments. Role-based access, encryption, and audit logs safeguard data integrity. Landlords gain full control over who accesses what, reducing exposure to breaches, leaks, or unauthorized internal activity.

Seamless Integration with Internal Tools

Custom software connects easily with existing systems such as maintenance trackers, tenant databases, or vendor platforms. Real-time syncing eliminates double entry and manual updates. This smooth integration improves data accuracy and operational speed, enabling landlords to manage all aspects of property operations from one centralized platform.

Scalable Licensing and Ownership

Full ownership gives landlords complete control over usage, upgrades, and user limits. There are no forced renewals, recurring licensing costs, or hidden fees. Growth in property count or staff doesn’t require complex re-licensing. Long-term cost predictability and ownership flexibility make custom software a strategic financial asset.

Rapid Feature Evolution

Custom platforms allow fast addition of new features based on evolving business needs. Landlords can request enhancements without waiting for vendor roadmaps. This agility ensures continued relevance and innovation. We maintain a competitive edge, and our software evolves in real time with the landlord’s strategies and market shifts.

Optimized for Local Regulations

Custom solutions are built to reflect specific regional rules, tax systems, and reporting formats. Landlords operating in areas with unique legal requirements benefit from automated compliance support. Accounting becomes less error-prone and more efficient. Manual adjustments, workarounds, or third-party plugins become unnecessary, saving both time and effort.

Wrapping Up

Financial reporting and accounting within property management benefit immensely from custom-built software. Precision, efficiency, and transparency emerge when systems align with real-world workflows, secure financial integrity, and empower deep insights. Tailoring ledgers, budgets, reports, access permissions, and data flows supports dynamic property portfolios and diverse landlord needs. Custom accounting modules eliminate bottlenecks, simplify reconciliation, automate reporting, and offer clarity to stakeholders and tax professionals. With property software for landlords, property owners can gain full control over their financial operations, with flexibility to evolve as business grows.

As operations demand more accuracy and agility, property management software development services from Dreamer Technoland stand ready to deliver stable systems tailored to each landlord’s vision. Our custom software development services include needs analysis, architecture design, intuitive interface development, integration capabilities, and maintenance support, ensuring that financial goals and operational workflow align perfectly. We prioritize scalability and adaptability, so your system grows seamlessly as your property portfolio expands. With a focus on long-term partnership, we deliver solutions that evolve with market demands and your business strategy.